Retirement planning basics

Top 3 retirement planning benefits offered by annuities

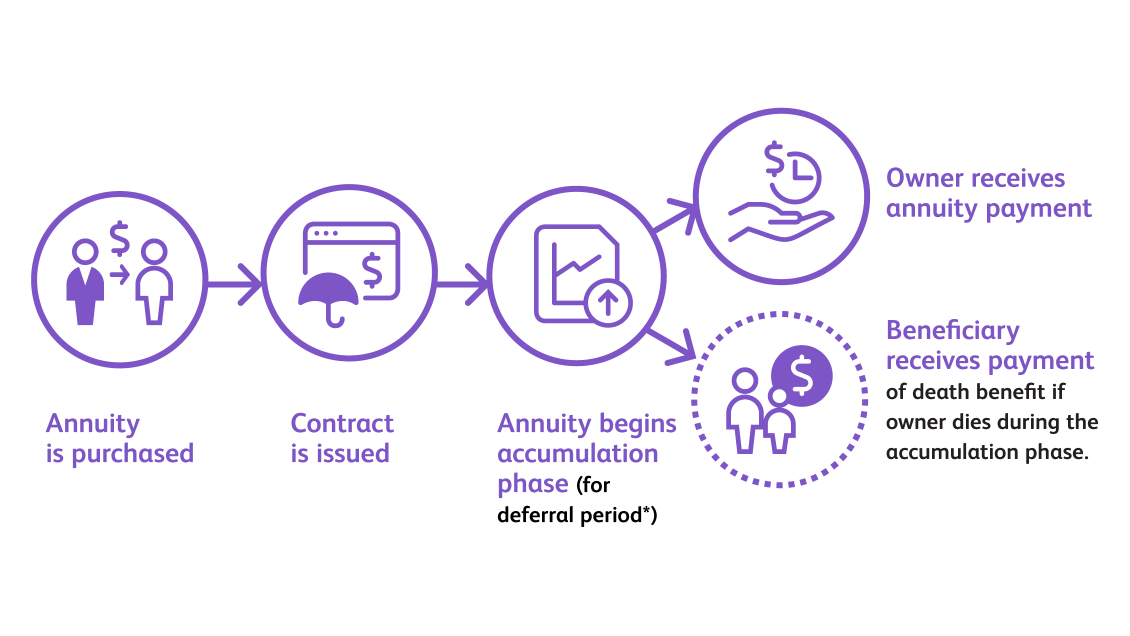

Explaining the 2 phases of annuities

Basic annuity designs: immediate or deferred?

Explore different types of annuities

Compare features for the potential fit

![]() *

*

Other related topics

We’re here for you

*Immediate annuities offer payout options that include survivor benefits.

Annuities are long-term insurance contracts intended for retirement planning. Annuities also may be subject to income tax and, if taken prior to age 59 ½, an additional 10% IRS tax penalty may apply. Because Protective and its representatives do not offer legal or tax advice, it is important that you talk with your own legal and tax advisor about your specific tax situation.

Indexed annuities are not an investment in any index, is not a security or stock market investment, does not participate in any stock or equity investment, and does not contain dividends.

WEB.3423234.12.21

To exercise your privacy choices,

To exercise your privacy choices,