Life checkups help you address clients' changing protection needs

Your clients’ lives are constantly changing, so the protection they need is probably changing, too. You can make sure they have the right life insurance coverage in place with regular life checkups — and we’re here to help.

Big life events can cause protection needs to change

Meeting with your clients at least once a year can uncover life changes that could have a big impact on their protection needs. If your client has recently experienced one of these events, it’s time for a life checkup to review their coverage and recommend solutions to fully protect the life they’ve built.

Work your anniversary leads to uncover life changes

A lot can happen in one year that can affect a client’s protection needs. Make sure their coverage still fits by checking in on their policy’s anniversary date. Get tips for working anniversary leads in our resource.

How to secure a life checkup meeting with your clients

Turn your anniversary leads into life checkup meetings in just a few simple steps.

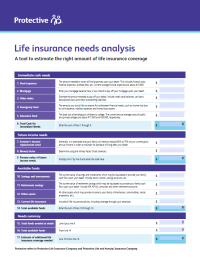

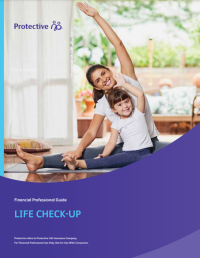

Conduct a life checkup with help from these tools

Use these resources to guide clients through a life checkup to discuss their current needs and future goals, and help you recommend the right protection as their life changes.

Offer the right solutions to protect where your client is going in life

As you conduct life checkups amid clients’ changing needs, be sure you're also staying up to speed on what you're recommending to address those changes.

We’re here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

WEB.3417506.01.26

To exercise your privacy choices,

To exercise your privacy choices,