Retirement income risks you can help clients avoid

Retirements are getting longer. Markets are unpredictable. There are risks that you can shed light on as part of a holistic retirement planning approach.

Planning today for tomorrow’s income

By working closely with clients, you can provide them with the information and resources to create a solid plan and avoid the miscalculations that can significantly affect their retirement income and lifestyle. Your insights into the role that rising health care costs and other risks will play can strengthen your relationship as it helps secure their future.

Prep for the potential retirement income pitfalls

For many, the greatest retirement income risks are:

- A poor sequence of returns

- Escalating health care costs

- Increases in longevity

Each can have a profound effect on retirement income and are worthy of a conversation. Our brochure helps you and your clients better understand these challenges.

Facing the risk of a declining market

If market driven investments are a primary source of retirement income, a poor sequence of returns just when the client starts taking income can be particularly damaging. Explore the market-related risks and guaranteed income solutions your client might consider.

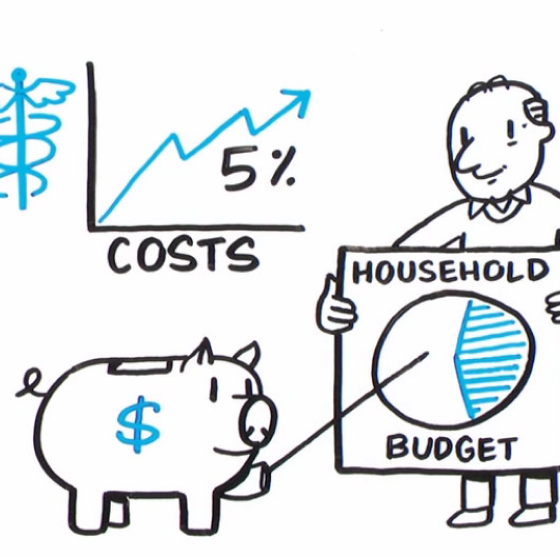

Clients need more than Medicare alone

Increased need for medical care coupled with escalating cost for services can have a more substantial impact on a client’s expenses than they might be expecting. Help clients understand the out-of-pocket costs and prepare for future needs with these resources.

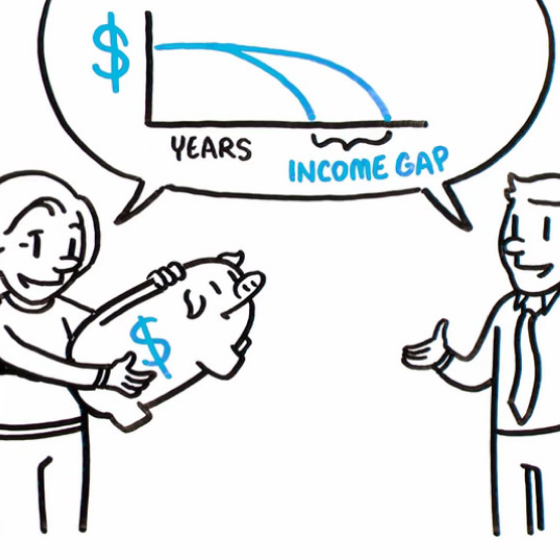

Help clients live longer without living leaner

The incremental increase in longevity has left some seniors unprepared for several additional years of retirement, at an average cost of nearly $50,000 per year. ¹ That creates an income gap that can be hard to fill. Introduce your clients to this potential dilemma with the help of our client video.

Other related topics

Risks to consider when accumulating retirement savings

Navigating life’s changes for retirement

Why guaranteed income can help support your clients' retirement confidence

We're here for you

We’re ready to help you deliver the protection and security your clients deserve. Reach out to us anytime for questions and support, and we’ll get in touch with you as soon as possible.

¹ Bureau of Labor Statistics, Consumer Expenditure Survey. April 2019

WEB.3026069.08.21

To exercise your privacy choices,

To exercise your privacy choices,